Flipkart Axis Bank Credit Card is a co-branded credit card that offers a range of benefits to its users. The card is designed to cater to the needs of frequent Flipkart shoppers who want to earn rewards on their purchases. The card is offered in partnership with Axis Bank, one of the leading banks in India.

The Flipkart Axis Bank Credit Card comes with a host of features that make it an attractive option for online shoppers. The card offers up to 5% cashback on Flipkart purchases, as well as discounts on partner merchants. Additionally, users can earn reward points on all other spends, which can be redeemed for vouchers and discounts.

Overall, the Flipkart Axis Bank Credit Card is a great option for those who frequently shop on Flipkart and want to earn rewards on their purchases. With its attractive benefits and features, the card is a must-have for anyone looking to get the most out of their online shopping experience.

Flipkart Axis Bank Credit Card Overview

The Flipkart Axis Bank Credit Card is a co-branded credit card offered by Axis Bank in partnership with the popular e-commerce platform, Flipkart. This credit card is designed for frequent online shoppers who want to earn rewards and save money while shopping.

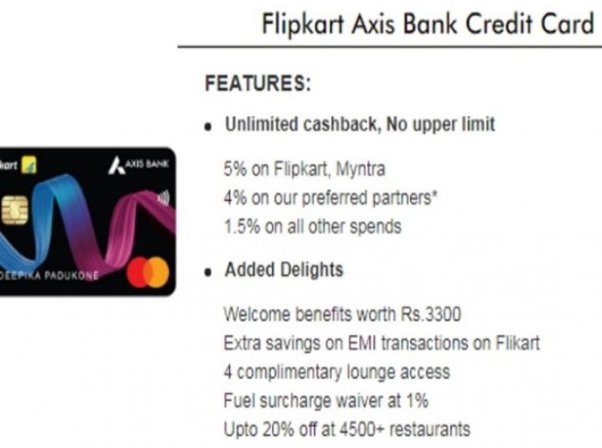

One of the key benefits of the Flipkart Axis Bank Credit Card is that it offers unlimited cashback on all purchases made on Flipkart, Myntra, and 2GUD. Additionally, cardholders can earn 4% cashback on all other online transactions and 1.5% cashback on all offline transactions.

Another notable feature of this credit card is that it offers a welcome bonus of 500 Flipkart gift vouchers to new cardholders who spend a minimum of Rs. 2,500 within the first 30 days of card activation. Cardholders can also earn up to 5% discount on flights, hotels, and holiday bookings made through Flipkart Travel.

The Flipkart Axis Bank Credit Card also comes with a range of other benefits, including fuel surcharge waivers, dining discounts, and exclusive access to airport lounges. Cardholders can also enjoy zero liability on lost or stolen cards and purchase protection against fraud.

Overall, the Flipkart Axis Bank Credit Card is a great option for frequent online shoppers who want to earn rewards and save money while shopping. With its generous cashback rewards, welcome bonus, and other benefits, this credit card can help cardholders make the most of their online shopping experiences.

Key Features and Benefits

Cashback Offers

The Flipkart Axis Bank Credit Card offers a range of cashback offers to its users. Cardholders can earn a 5% cashback on purchases made on Flipkart, Myntra, and 2GUD. Additionally, they can earn a 4% cashback on purchases made on preferred merchants such as MakeMyTrip, Goibibo, Uber, and more. The maximum cashback that can be earned per month is Rs. 500.

Welcome Benefits

New cardholders of the Flipkart Axis Bank Credit Card can enjoy a range of welcome benefits. Upon activation of the card, they can earn a Flipkart voucher worth Rs. 500. Furthermore, they can earn a cashback of Rs. 500 on their first purchase made within 30 days of card activation.

Reward Points System

The Flipkart Axis Bank Credit Card has a reward points system that allows cardholders to earn reward points on every purchase made using the card. Cardholders can earn 2 reward points for every Rs. 200 spent on the card. These reward points can be redeemed for a range of products and services on the Flipkart platform.

Overall, the Flipkart Axis Bank Credit Card offers a range of benefits to its users, including cashback offers, welcome benefits, and a reward points system. Cardholders can enjoy these benefits while making purchases on Flipkart, Myntra, and other preferred merchants.

Eligibility and Application Process

Eligibility Criteria

To be eligible for the Flipkart Axis Bank Credit Card, the applicant must meet the following criteria:

- The applicant must be an Indian resident.

- The applicant must be between 18 and 70 years of age.

- The applicant must have a minimum monthly income of Rs. 20,000.

- The applicant must have a good credit score.

Application Steps

The application process for the Flipkart Axis Bank Credit Card is straightforward and can be completed online. Here are the steps to follow:

- Visit the Axis Bank website and navigate to the Flipkart Axis Bank Credit Card page.

- Click on the “Apply Now” button.

- Fill in the application form with the required details, such as name, contact details, income, and employment status.

- Upload the necessary documents, such as identity proof, address proof, and income proof.

- Review the application form and submit it.

Once the application is submitted, Axis Bank will review it and may contact the applicant for further information or verification. If the application is approved, the Flipkart Axis Bank Credit Card will be sent to the applicant’s registered address within 7-10 working days.

It is important to note that meeting the eligibility criteria does not guarantee approval of the credit card application. The final decision rests with Axis Bank, and they may reject the application if they deem it necessary.

Fees and Charges

Annual Fees

The Flipkart Axis Bank Credit Card comes with an annual fee of Rs. 500. However, this fee can be waived off if the user spends Rs. 2,00,000 or more in a year using the card.

Interest Rates

The interest rate on the Flipkart Axis Bank Credit Card is 3.25% per month, which translates to an annual interest rate of 39%. This interest rate is applicable on all outstanding balances and cash advances taken using the card.

Other Charges

Apart from the annual fee and interest rate, the Flipkart Axis Bank Credit Card also has other charges that users should be aware of. These charges include:

- Late Payment Fee: If the user fails to pay the minimum amount due on the card, a late payment fee of Rs. 100 to Rs. 700 will be charged, depending on the outstanding balance.

- Overlimit Fee: If the user exceeds the credit limit on the card, an overlimit fee of Rs. 500 will be charged.

- Cash Advance Fee: If the user withdraws cash using the card, a cash advance fee of 2.5% of the transaction amount or Rs. 500, whichever is higher, will be charged.

- Foreign Currency Transaction Fee: If the user uses the card for transactions in a foreign currency, a foreign currency transaction fee of 3.5% will be charged.

It is important for users to keep these fees and charges in mind while using the Flipkart Axis Bank Credit Card to avoid any unpleasant surprises.

Card Management and Security Features

Online Account Management

Flipkart Axis Bank Credit Cardholders can manage their credit card account online through the Axis Bank internet banking portal. This portal allows cardholders to view their account balance, transaction history, and credit limit. Additionally, cardholders can also view their reward points balance and redeem them for various offers available on the Flipkart platform.

The online account management system also allows cardholders to set up alerts and notifications for various transactions, such as when a transaction is made above a certain amount or when the credit limit is reached. This feature helps cardholders keep track of their spending and avoid overspending.

Security Protocols

Flipkart Axis Bank Credit Card comes with various security features to ensure the safety of the cardholder’s account. The card is equipped with an EMV chip that provides enhanced security against fraud and skimming. Additionally, the card comes with a PIN that is required for all transactions, adding an extra layer of security.

Axis Bank also provides a 24×7 fraud monitoring system that detects any suspicious activity on the card and alerts the cardholder immediately. In case of a lost or stolen card, the cardholder can block the card through the Axis Bank internet banking portal or by calling the customer care center.

Overall, Flipkart Axis Bank Credit Card provides robust card management and security features that help cardholders manage their account and keep it secure.

Customer Support and Services

Flipkart Axis Bank Credit Card offers excellent customer support and services to ensure that their customers have a smooth and hassle-free experience. The customer support team is available 24/7 to assist customers with any queries or issues they may face.

The credit card also offers a range of services to enhance the customer experience. These services include:

- Lost card liability: In case the card is lost or stolen, the cardholder is not liable for any fraudulent transactions made on the card after reporting the loss to the bank.

- Emergency card replacement: In case the card is lost or stolen, the cardholder can request an emergency card replacement, which will be delivered within 3 working days.

- Zero liability on fraudulent transactions: The cardholder is not liable for any fraudulent transactions made on the card if they report the transaction to the bank within 24 hours.

- Online account management: The cardholder can manage their account online through the Axis Bank website or mobile app. They can view their account statement, pay bills, and track their rewards points.

Overall, the Flipkart Axis Bank Credit Card offers excellent customer support and services, making it a reliable and convenient choice for customers.

Conclusion

The Flipkart Axis Bank Credit Card is a great option for frequent shoppers on Flipkart and its partner stores. With its generous rewards program and exclusive discounts, cardholders can save money and earn rewards on their purchases. The card also offers a range of other benefits, including airport lounge access, fuel surcharge waivers, and more.

One of the standout features of the card is its accelerated rewards program, which offers 5% cashback on Flipkart purchases, 4% cashback on partner stores, and 1.5% cashback on all other purchases. This makes it an excellent choice for those who do a lot of shopping online or at Flipkart’s partner stores.

Another benefit of the Flipkart Axis Bank Credit Card is the exclusive discounts it offers on Flipkart and partner stores. Cardholders can save up to 10% on their purchases, which can add up to significant savings over time.

Overall, the Flipkart Axis Bank Credit Card is a great choice for those who shop frequently at Flipkart and its partner stores. With its generous rewards program, exclusive discounts, and other benefits, it offers excellent value for money.