Health insurance is one of the most important financial decisions you’ll make. With rising healthcare costs and a myriad of plans to choose from, finding the right health insurance can feel overwhelming. This guide will walk you through the essential steps to help you choose the best health insurance plan for your needs.

Understanding the Basics of Health Insurance

Before diving into the specifics, it’s important to grasp the basics of health insurance. This foundation will help you make informed decisions as you explore your options.

What is Health Insurance?

Health insurance is a contract between you and an insurance company that covers a portion of your medical expenses. In exchange for a monthly premium, your insurance provider agrees to pay for some or all of your healthcare costs, depending on the terms of your policy.

Why Health Insurance is Essential

Health insurance is crucial for several reasons:

- Financial Protection: Medical emergencies can be costly, and health insurance helps to protect you from high out-of-pocket expenses.

- Access to Care: With insurance, you gain access to a network of healthcare providers, ensuring that you receive the necessary medical care when you need it.

- Preventive Care: Many health plans cover preventive services, such as vaccinations and screenings, helping you stay healthy and catch potential health issues early.

Assessing Your Healthcare Needs

Choosing the best health insurance plan starts with understanding your healthcare needs. Different plans offer various levels of coverage, so it’s important to select one that aligns with your personal health situation.

Evaluate Your Health History

Start by assessing your health history and that of your family. Consider the following:

- Chronic Conditions: Do you have any chronic conditions that require regular treatment or medication?

- Medical Visits: How often do you visit doctors or specialists?

- Prescription Drugs: Do you take any long-term medications?

Understanding your health history will help you choose a plan that provides sufficient coverage for your specific needs.

Consider Your Family’s Health History

Your family’s health history can also influence your choice of a health insurance plan. If there’s a history of hereditary conditions such as diabetes, heart disease, or cancer, you might need a plan with more comprehensive coverage.

Think About Future Health Needs

It’s also important to consider any future health needs. Are you planning to start a family? Do you anticipate needing surgery or other medical procedures? Selecting a plan that covers potential future needs can save you money and stress down the line.

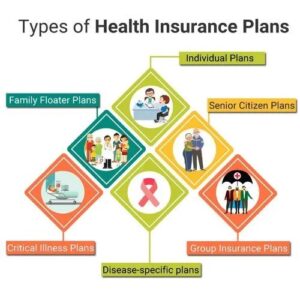

Different Types of Health Insurance Plans

There are various types of health insurance plans, each with its own structure, benefits, and limitations. Understanding the differences can help you choose a plan that best fits your needs.

Health Maintenance Organization (HMO) Plans

HMO plans are known for their lower premiums and limited provider networks. Under an HMO plan, you must choose a primary care physician (PCP) who coordinates all your care. Referrals from your PCP are typically required to see specialists.

Pros of HMO Plans:

- Lower premiums

- Lower out-of-pocket costs

- Emphasis on preventive care

Cons of HMO Plans:

- Limited choice of healthcare providers

- Requires referrals for specialists

- No coverage for out-of-network care (except in emergencies)

Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility in choosing healthcare providers. You don’t need a referral to see a specialist, and you can visit out-of-network providers, though at a higher cost.

Pros of PPO Plans:

- Flexibility to see any doctor, including specialists

- No referrals needed for specialists

- Coverage for out-of-network care

Cons of PPO Plans:

- Higher premiums and out-of-pocket costs

- More complex billing process

Exclusive Provider Organization (EPO) Plans

EPO plans combine aspects of HMO and PPO plans. They offer a network of providers but typically do not require referrals to see specialists. However, there is no coverage for out-of-network care except in emergencies.

Pros of EPO Plans:

- Lower premiums compared to PPO plans

- No need for specialist referrals

- Simplified network management

Cons of EPO Plans:

- No coverage for out-of-network care

- Limited provider network

Point of Service (POS) Plans

POS plans are a hybrid of HMO and PPO plans. Like an HMO, you need to choose a primary care physician and get referrals to see specialists. However, like a PPO, you can see out-of-network providers, but at a higher cost.

Pros of POS Plans:

- Flexibility to see out-of-network providers

- Typically lower out-of-pocket costs than PPO plans

- Coverage for a broad range of services

Cons of POS Plans:

- Requires referrals for specialists

- Higher out-of-network costs

High-Deductible Health Plans (HDHP) with Health Savings Accounts (HSAs)

HDHPs offer lower premiums but come with higher deductibles. They are often paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars for medical expenses.

Pros of HDHPs:

- Lower premiums

- Potential tax savings with an HSA

- Encourages careful consideration of healthcare spending

Cons of HDHPs:

- Higher out-of-pocket costs before the deductible is met

- Can be costly in the event of an unexpected medical emergency

Key Features to Consider in a Health Insurance Plan

When evaluating health insurance plans, it’s important to look beyond the premium and consider other key features that will impact your healthcare costs and access to care.

Premiums

The premium is the amount you pay for your health insurance, usually on a monthly basis. While lower premiums might be appealing, they often come with higher deductibles and out-of-pocket costs. Make sure you balance the premium with the plan’s other costs.

Deductibles

The deductible is the amount you must pay out of pocket before your insurance starts covering costs. Plans with higher deductibles typically have lower premiums, but you’ll pay more out of pocket if you need medical care.

Co-payments and Co-insurance

Co-payments (co-pays) are fixed amounts you pay for specific services, like a doctor’s visit. Co-insurance is the percentage of costs you share with the insurance company after meeting your deductible. Understanding these costs will help you predict your out-of-pocket expenses.

Out-of-pocket Maximums

The out-of-pocket maximum is the most you will pay for covered services in a policy period. Once you reach this limit, your insurance company pays 100% of eligible expenses. This feature is crucial for protecting you from high medical bills in case of serious illness or injury.

Coverage Limits

Some health insurance plans have coverage limits on certain services or total annual benefits. Be aware of these limits to avoid unexpected expenses. Make sure the plan’s coverage limits align with your healthcare needs.

Network of Providers

The network of providers in a health insurance plan is a critical factor in ensuring you have access to the care you need.

In-Network vs. Out-of-Network Providers

In-network providers have agreements with insurance companies to provide services at lower rates. If you use out-of-network providers, you may face higher costs or no coverage at all.

Checking the Network Coverage

Before choosing a plan, verify that your preferred doctors, specialists, and hospitals are in the network. If you have a specific healthcare provider or facility you prefer, make sure they are covered under the plan you are considering.

Importance of a Broad Network

A plan with a broad network gives you more options for healthcare providers. This can be particularly important if you require specialized care or if you travel frequently and need access to providers in different locations.

Prescription Drug Coverage

Prescription drug coverage is an essential part of any health insurance plan, especially if you take medications regularly.

Formulary Lists

A formulary list is a list of medications covered by a health insurance plan. These lists are often tiered, with different levels of coverage for generic, brand-name, and specialty drugs.

Tiered Coverage Systems

Many plans use a tiered system where drugs are categorized based on cost. Understanding these tiers can help you anticipate out-of-pocket expenses for your prescriptions. For example, generic drugs are usually in the lowest tier and are the most affordable, while specialty drugs are often in the highest tier and can be much more expensive.

Costs Associated with Prescription Drugs

Consider the co-payments or co-insurance for prescription drugs, especially if you require long-term medication. Compare these costs across different plans to find the best option for your needs. Some plans may also have specific requirements for certain medications, such as prior authorization or step therapy.

Coverage for Chronic Conditions and Special Medications

If you have a chronic condition or require special medications, ensure the plan you choose covers these adequately. Some plans may have restrictions or require prior authorization for certain drugs, so it’s important to review the plan’s formulary list carefully.

Evaluating Plan Costs

When evaluating health insurance plans, it’s essential to understand the total cost of the plan, including not just the premium but also the out-of-pocket costs you may incur.

Total Annual Costs

Consider the total annual cost of your plan, which includes premiums, deductibles, co-payments, co-insurance, and out-of-pocket maximums. This comprehensive view helps you understand your financial commitment.

Comparing Costs Across Plans

Compare the total costs across different plans to see which offers the best value based on your healthcare needs. A plan with a higher premium might have lower out-of-pocket costs, making it a better choice if you need frequent medical care.

Balancing Premiums vs. Out-of-Pocket Costs

When choosing a plan, balance the trade-off between premiums and out-of-pocket costs. A plan with low premiums might result in higher costs when you access healthcare services, while a higher premium plan might reduce your out-of-pocket expenses.

Tax Implications and Savings Options

If you choose a High-Deductible Health Plan (HDHP), you may be eligible to contribute to a Health Savings Account (HSA). Contributions to an HSA are tax-deductible, and funds can be used tax-free for qualified medical expenses. This can provide significant savings and financial flexibility.

Legal and Regulatory Considerations

Health insurance is regulated by federal and state laws, and it’s important to understand these regulations when choosing a plan.

The Affordable Care Act (ACA)

The Affordable Care Act (ACA) established minimum standards for health insurance plans, including essential health benefits, coverage for pre-existing conditions, and limits on out-of-pocket expenses. Ensure your plan complies with ACA regulations to avoid gaps in coverage.

State-specific Regulations

Health insurance regulations can vary by state. Some states have additional requirements or protections that go beyond federal regulations. Be aware of your state’s specific rules when choosing a plan.

Coverage for Pre-existing Conditions

Under the ACA, health insurance plans cannot deny coverage or charge higher premiums based on pre-existing conditions. Ensure the plan you choose covers any pre-existing conditions you or your family members may have.

Health Insurance Portability and Accountability Act (HIPAA)

HIPAA protects your privacy and ensures the security of your health information. It also allows for the continuation of coverage when you change or lose your job. Make sure your plan complies with HIPAA regulations to protect your rights.

Employer-Sponsored vs. Individual Plans

Deciding between an employer-sponsored plan and an individual plan depends on several factors, including cost, coverage options, and your personal situation.

Advantages of Employer-Sponsored Plans

Employer-sponsored plans often have lower premiums because employers contribute to the cost. These plans may also offer more comprehensive coverage options.

Evaluating Employer Contributions

Understand your employer’s contribution to your health insurance plan. A higher employer contribution can significantly reduce your out-of-pocket costs, making an employer-sponsored plan a cost-effective option.

Individual Plans and Marketplaces

If your employer does not offer health insurance, or if you are self-employed, you can purchase an individual plan through the Health Insurance Marketplace. These plans may offer more flexibility but often come with higher premiums.

Self-employed and Small Business Options

Self-employed individuals and small business owners have unique options, including the ability to purchase group health insurance plans. These options can provide coverage at more affordable rates compared to individual plans.

How to Compare Health Insurance Plans

Comparing health insurance plans can be complex, but using the right tools and strategies can simplify the process.

Using Comparison Tools

Online comparison tools allow you to compare different health insurance plans side by side, considering factors like premiums, deductibles, and coverage options. These tools can help you identify the best plan for your needs.

Reading and Understanding Plan Summaries

Plan summaries provide a high-level overview of what a health insurance plan covers, including key features and costs. Carefully review these summaries to ensure the plan meets your needs.

Importance of Plan Ratings and Reviews

Look for ratings and reviews from current or past plan members. These can provide insights into the plan’s customer service, ease of use, and overall satisfaction. Ratings and reviews can also help you identify potential issues with a plan before you commit to it.

Case Studies: Real-life Examples

Reviewing case studies or real-life examples of how different plans have worked for others can help you understand the practical implications of your choice. This can be particularly useful for understanding how plans handle claims and coverage issues.

Understanding Enrollment Periods

Enrollment periods are critical windows of time when you can sign up for or change your health insurance plan.

Open Enrollment Periods

The open enrollment period is the designated time each year when you can enroll in a health insurance plan. Missing this period can leave you without coverage for the upcoming year. Make sure you mark these dates on your calendar and prepare in advance.

Special Enrollment Periods

Special enrollment periods allow you to enroll outside of the regular open enrollment period due to qualifying life events, such as marriage, the birth of a child, or the loss of other coverage. If you experience a qualifying event, make sure to take advantage of the special enrollment period to ensure you have coverage.

Consequences of Missing Enrollment Deadlines

If you miss the enrollment deadlines, you may have to wait until the next open enrollment period, unless you qualify for a special enrollment period. This could leave you without coverage for an extended period, exposing you to financial risk in the event of a medical emergency.

Conclusion: Making an Informed Decision

Choosing the best health insurance plan requires careful consideration of your healthcare needs, financial situation, and the features of different plans. By understanding the different types of health insurance plans, assessing your healthcare needs, and carefully comparing your options, you can make an informed decision that provides the best coverage for you and your family.

Final Tips for Choosing the Right Plan

- Do Your Research: Use comparison tools and read plan summaries to fully understand what each plan offers.

- Think Long-term: Consider how your health needs may change over time and choose a plan that will adapt with you.

- Review Annually: Health insurance plans and your health needs can change, so review your plan annually to ensure it still meets your needs.

Regularly Reviewing Your Health Insurance Coverage

Your health insurance needs can change as you go through different life stages, so it’s essential to regularly review and adjust your coverage. Whether it’s a new job, a growing family, or changes in your health, staying informed and proactive about your health insurance choices will help ensure you always have the coverage you need.